Businesses will have to face significantly higher ETS surcharges when importing into the EU

1. What is an ETS surcharge?

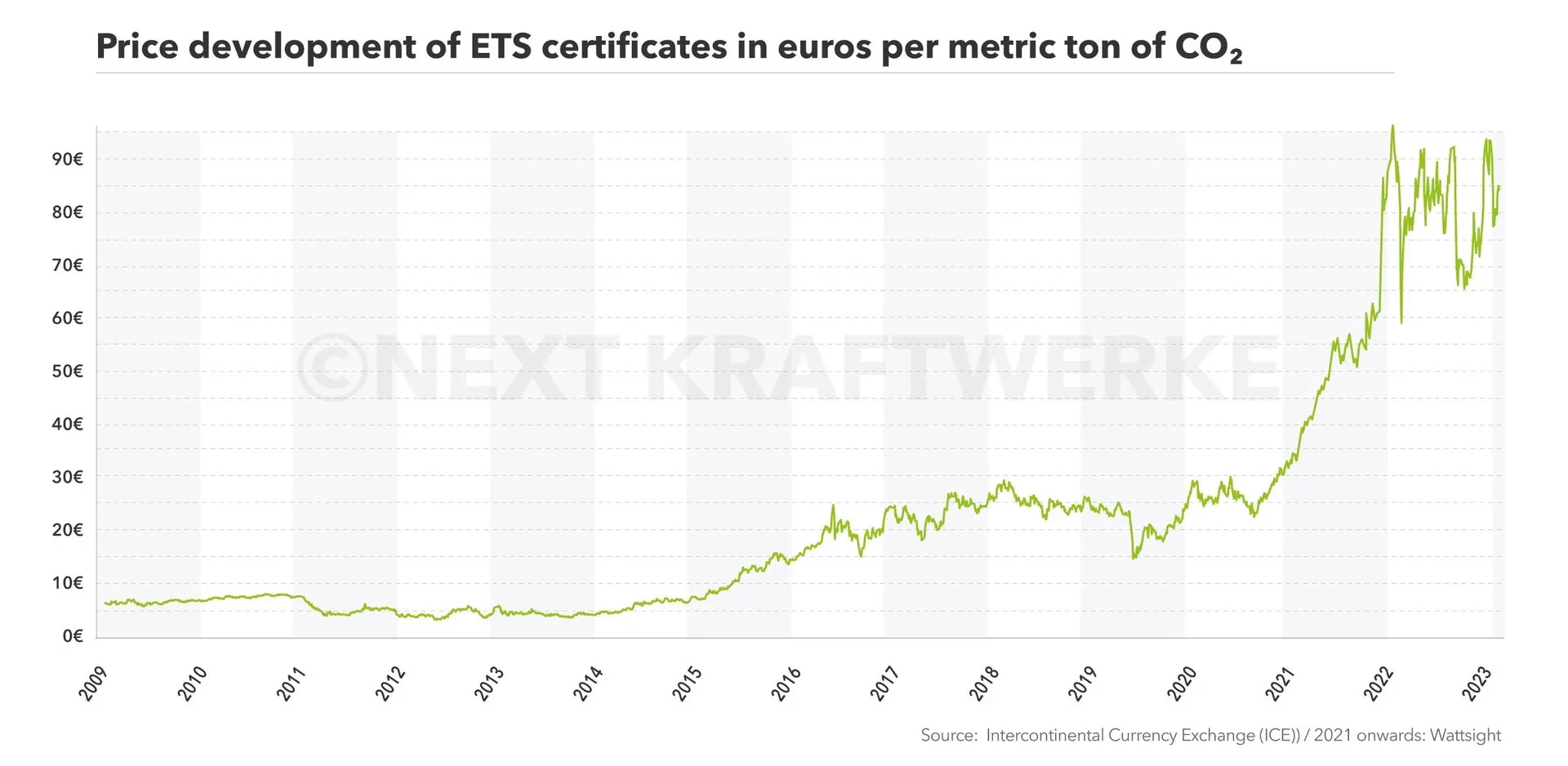

ETS or EU ETS (European Union Emissions Trading Scheme) is the European Union Emissions Trading System. This is the world's first and most significant international program designed to reduce greenhouse gas emissions from all industrial sectors. The program allows EU member states to buy, sell, and trade permitted emissions allowances intending to curb climate change and global warming. If a factory's emissions exceed its allowed limit, the operator must purchase additional certificates to continue operations. The rising prices of EU ETS certificates in the European market per ton of CO2 emitted indicate that the EU is increasingly imposing stricter control over emissions released into the environment.

An ETS surcharge refers to the fee that companies have to pay when importing goods into the EU. It relates to the EU's carbon trading program (EU Emissions Trading Scheme - ETS). Specifically, if a factory emits more carbon than its permitted allowances under the ETS, it needs to purchase additional allowances. The increasing price of these carbon allowances in the EU market shows tighter emission controls by the EU. The ETS surcharge is the fee importers pay related to the rising cost of carbon allowances under the EU's ETS program.

ETS was constructed in 4 consecutive phases: Phase I (2005-2007, often referred to as the "pilot phase"); Phase II (2008-2012); Phase III (2013-2020); Phase IV starting from 2021. Operating based on the "cap-and-trade" principle (emissions cap and trading), ETS limits the permitted emissions volumes and allows emitters to buy or sell certain emissions quotas. The cap will determine the number of carbon credits valid across the whole EU ETS system and is designed to decrease each year, thereby reducing total emissions gradually.

Each year, a certain carbon quota will be allocated freely to businesses, and the remainder will become credits traded on the market. There, companies carry out buying and selling of carbon credits, called the carbon credit trading platform. By 2034, the EU is expected to remove free emissions quotas and operate the entire CBAM mechanism.

To promote progress towards Net Zero as soon as possible, the European Commission (EC) announced its ambitious "Fit for 55" action plan on July 14, 2021, raising the target from reducing emissions by 40% to 55% in 2030, compared to 1990 levels and achieving carbon neutrality by 2050. The contents of "Fit for 55" include the following key points:

- Expanding carbon emissions trading (ETS)

- Tightening environmental standards for new car CO2 emissions

- Banning the sale of new cars using diesel and gasoline engines from 2035

- Renewable energy accounting for 40% of energy production by 2030

- Applying a carbon border adjustment mechanism (CBAM) for imported goods

2. Prices are expected to experience significant fluctuations

Major shipping lines such as Maersk, Hapag–Lloyd, and Yang Ming have already informed cargo owners about the ETS surcharge that will be applied from January 1, 2024. Specifically, when shipping companies have to comply with the European Union's emissions trading system, Maersk believes that compliance costs are expected to be very large, will continue to increase with each implementation phase, and will apply to all ship voyages within the scope of EU-ETS. Starting January 1, 2024, ship operators will have to monitor and report emissions volumes as well as pay a surcharge for each ton of CO2 emitted within the European Economic Area and 50% of voyages ending or starting at European ports.

To offset the environmental damages, for the Asia-Northern Europe route, Maersk will charge shippers a fee of €70/FEU, while Hapad-Lloyd estimates a fee of €12/TEU, and Yang Ming will charge €24/TEU (for dry containers). For the Northern Europe-United States route, Maersk expects a fee of €81/FEU, while Hapag-Lloyd forecasts a fee of €9/TEU for the Northern Europe-US East Coast route, and Yang Ming announced a rate of €27/TEU (for dry containers) for the Europe-North America route.

This surcharge will be calculated quarterly for shippers applied from Q1 2024. With mandatory transportation payments, including 40% of greenhouse gas emissions in 2024, increasing to 70% in 2025 and collecting 100% in 2026.

Starting in 2024, shipping companies must purchase a European emission allowance (EUA) for each ton of CO2 reported as emitted and submit it to the European Union each year. EUAs can be purchased through exchanges such as the Intercontinental Exchange, European Energy Exchange, Nasdaq exchange, and over-the-counter markets between service providers and customers.

According to calculations by Hecla Emissions Management - a provider of ETS solutions for the shipping industry, the compliance cost of ETS for shipping will yield over USD 3.2 billion in 2024. It could increase to USD 9.1 billion by 2026.

The emissions surcharge will be updated quarterly to align with changes in EUA prices, and the value of ETS applied will depend mainly on specific port calls. For Maersk, Hapag-Lloyd, and Yang Ming, the ETS surcharge is clearly defined and separated from freight rates, with fees calculated based on a formula combining CO2 emissions related to ETS and market prices for EUAs.

Previously, some shipping lines had collected the ETS surcharge from shippers under three common forms: Separate, Combined, and Voluntary.

Maritime transport accounts for 13% of total greenhouse gas emissions from European transport activities. Therefore, revenues from the ETS source will be channeled into the shipping sector to support the transition process to alternative energy sources.

The economy is facing many difficulties, increasing surcharges for shippers, along with the Israel-Hamas conflict causing shockwaves for the logistics and global supply chain. All these fluctuations have, are, and will adversely affect Vietnamese importing and exporting businesses, so it is necessary to re-evaluate plans and develop new strategies to minimize risks.