Forecast of sea freight rate trends in 2024

Although demand is expected to recover by 2.5% in 2024, the maritime transport industry will still face difficulties when vessel capacity grows at 6.8% to reach a new record of 2.7 million TEUs globally. Drewry's Supply/Demand Index is forecasted at 74.3 points for 2024, the lowest level ever reported. To maintain profits, shipping lines will implement strategies such as bypassing congested ports and maintaining slow vessel speeds to optimize costs, keeping freight rates at safe levels. Senior Research Director for Container Shipping at Drewry - Simon Heaney expected freight rates to drop 60% in 2023 "then a 33% decrease in 2024." According to Heaney, low freight rates are the result of long-term supply and demand imbalances.

At the end of 2023, the container shipping market saw a coordinated shift away from the Red Sea to avoid potential impacts on cargo owners from possible Houthi rebel attacks. Re-routing vessels around the Cape of Good Hope increased voyage times by 10 to 20 days, caused refueling delays at African ports and container imbalances. This put pressure on productivity and led to surcharges. Shipping lines will have to contend with hazards in the Indian Ocean, where seas are rougher and piracy threats exist in some coastal areas of Africa. Insurance costs will also be higher than just a few weeks ago under the previous conditions. Given the volatile situation and disruptions currently occurring due to geopolitical tensions, these trends are expected to continue into 2024, with deeper impacts on global supply chains. Therefore, the industry will need to adapt to these changes and find ways to minimize their maximum impact on global supply chains.

Regulations on the environment such as the EU Emissions Trading System (ETS), effective from January 01, 2024, will have significant impacts. Shipping lines will face pressure to reduce carbon emissions and meet emission reduction targets, requiring innovative measures and sustainable practices. Maritime transport will shift to using lower-emission fuels such as LNG and hydrogen fuels, thereby reducing greenhouse gas emissions. At the same time, electric and hybrid technologies are increasingly attractive, further contributing to the industry's environmental protection efforts. Patrik Berglund, CEO of Xeneta, said: "The new environmental regulations introduced in 2024 are an added complexity for shipping lines in an already challenging market. Many shipowners cannot optimize loads as some of their ships do not meet environmental conditions and will have to leave the market. As a result, we will continue to see slow steaming and port omissions."

Currently, seaborne freight rates from Asia continued on an upward trajectory last week, recovering from October lows as shipping lines adjusted capacity to match reduced volumes in Q4 2023. Against the complex backdrop of the Red Sea, costs on routes continue to rise sharply. Hapag-Lloyd forecasts global volumes will increase 4% in 2024, along with an 8% increase in capacity. This projection indicates overcapacity issues may persist into next year. Recent cuts in transits through the Panama Canal have caused congestion, impacting some North-South trade lanes, although to date there have been no significant impacts on major container carriers.

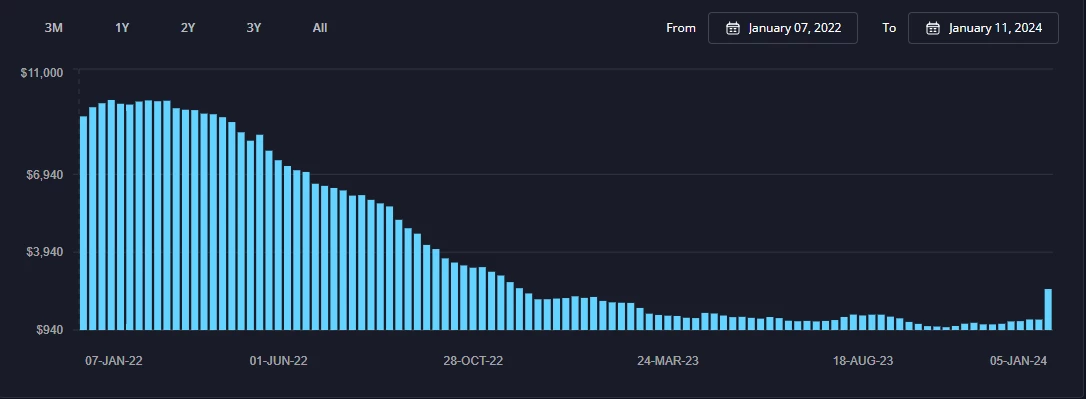

Sea freight rates - Freightos Baltic Index as of 05/01/2024:

-

The Freightos Baltic International Freight Index (FBX) increased 88% to US$2,519/FEU.

-

Asia-West Coast USA (FBX01 Weekly) rate increased 60% to US$2,713/FEU.

-

Asia-East Coast USA (FBX03 Weekly) rate increased 58% to US$3,980/FEU.

-

Asia-North Europe (FBX11 Weekly) rate increased 176% to US$4,931/FEU.

-

Asia-Mediterranean (FBX13 Weekly) rate increased 115% to US$5,169/FEU.

The tense war situation led to major price fluctuations over just the past month, but these changes will soon be resolved as the geopolitical situation stabilizes and the overall outlook expects rates to remain at low levels in Q3, Q4 of 2024.

In the current context, many importers and exporters are wondering when they can expect freight rates and transportation costs to stabilize. It is difficult to accurately forecast an unexpected "black swan" event like the Red Sea.