How will Vietnam's exports change when the new US President takes office?

There is significant pressure on businesses exporting to the US.

The world is eagerly awaiting the outcome of the US presidential election on November 5th. Regardless of whether Donald Trump of the Republican Party or Kamala Harris of the Democratic Party wins, the new administration will likely continue pursuing international trade policies that protect American businesses.

The latest reports on consumer markets indicate that Americans are expected to spend more than anticipated on various goods. According to estimates from the National Retail Federation (NRF), total US spending during the holiday season in November and December 2024 is projected to reach around $980-989 billion, an increase of 2.5-3.5% compared to the same period last year.

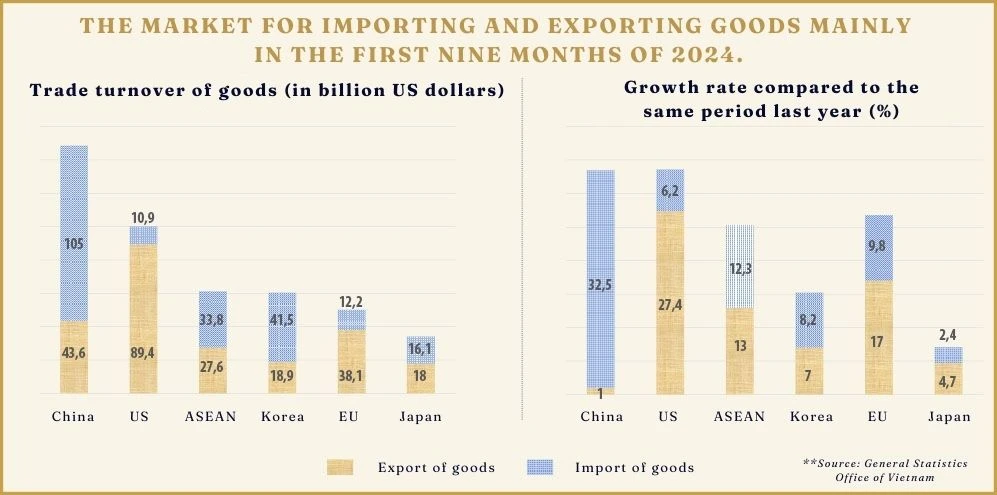

In the first 9 months of 2024, the US remained Vietnam's largest export market with a trade value of over $89 billion, boosting Vietnam's trade surplus with the US to around $78.5 billion, a 31% increase compared to the same period the previous year. Despite positive signals from the US market, Vietnamese exporters to the US are concerned because both Donald Trump and Kamala Harris have announced plans to increase import taxes, although there are differences in their tax policies.

Many analysts believe that Trump may soon impose a 60% tax on Chinese goods and a 20% tax on goods from other countries, potentially disrupting global trade. Expanding fiscal policies could worsen inflation.

On the other hand, Harris argues that Trump's proposed 10% tax increase on all imported goods would burden American consumers with higher expenses. She proposes using tax credits to support domestic businesses in developing sectors like clean energy, semiconductor chips, solar panels, electric vehicles, acting as an indirect tax.

Therefore, the difference between Trump's and Harris's policies lies in the extent and scale of how tax increases are implemented. Trump uses taxes as a protective barrier to boost domestic production, while Harris is also erecting barriers albeit less stringent, with the aim of shielding American businesses.

How will Vietnamese goods benefit after the US presidential election?

From another perspective, Michael Kokalari, CFA, Director of Macroeconomic Analysis and Market Research at VinaCapital Investment Management, suggests that if Trump is elected, he is expected to focus on devaluing the dollar rather than raising taxes. Tax hikes could increase inflation in the US, while a weaker dollar could help the US government address various issues.

A weaker dollar would boost Vietnam's exports to countries outside the US, and imposing a 10-20% tax on imports from countries other than China would not diminish Vietnam's competitiveness. Additionally, if the US imposes a 60% tax on Chinese goods, Vietnam and Mexico would once again benefit the most in terms of exports, according to reports from Standard Chartered and other organizations.

In a report released in early September 2024 by Vinacapital, Michael Kokalari stated that Vietnam is one of the three countries in the world with the closest economic ties to the US, ranking behind only Canada and Mexico.

Looking ahead after the US presidential election, Kokalari believes that the demand for "Made in Vietnam" products in the US may slow down but not significantly decrease in early 2025.

Most economists agree that Trump's proposed import tax increases would have more negative effects than positive ones. Taxes could lead to trade confrontations, including trade wars, causing harm to all countries, limiting global trade flows, disrupting supply chains, hampering overall economic growth, and likely leading to inflationary pressures.