Import & Export challenge in 2023

General situation on Import-Export and Manufacturing

Industrial production situation

In January 2023, due to the two holidays of the New Year and Lunar New Year, the working time was only 1/3 of the previous months. Outside orders decreased, and businesses mainly focused on producing goods to serve domestic consumption during Tet. Hence, the development index of industrial production, trade, and import and export decreased during the month compared to the previous month and the same period of the last year.

The index of industrial production (IIP) in January 2023 was estimated to decrease by 14.6% over the previous month and down by 8% compared to the same period last year.

- Processing and manufacturing industry: 9.1% decrease, reducing 7 percentage points in the overall increase.

- Mining industry: 4.9% decrease, reducing 0.8 percentage points.

- Power generation and distribution industry: 3.4% decrease, reducing 0.3 percentage points.

- Water supply industry: Wastewater management and treatment activities increased by 3.7%, contributing 0.1 percentage points.

The number of employees working in industrial enterprises as of January 1, 2023, decreased by 0.9% compared to the same period last month and increased by 0.2% compared to the same period the previous year.

In addition to the reason that January has a long Lunar New Year holiday, on the other hand, the world economy is challenging, and consumer demand decreases, leading to a decrease in new orders, directly affecting export results. However, the trade balance of goods in January 2023 still maintained a trade surplus of USD 3.6 billion (the same period had a trade surplus of USD 1.6 billion); total retail sales of goods and services increased by 20% (the same period increased by 1.3%).

Import-Export of goods situation

Vietnam's export growth will depend on many factors, such as world conflicts, inflation control, measures to prevent and combat the Covid-19 pandemic, economic developments in large import markets, etc. Otherwise, the FTAs will continue to be implemented with the tariff reduction roadmap. Promoting socio-economic recovery and development programs will be the driving force to promote production and export. The favorable attraction of domestic and foreign investment will create new production capacity for export. On the other hand, Vietnamese import-export businesses need to take specific measures when countries are racing toward the Net Zero goal.

- Exports turnover: It was estimated at $25.08 billion, down 13.6% from the previous month and 21.3% over the same period last year. The structure of the export commodity group in January 2023, the group of processed industrial products, accounted for 89%.

- Import turnover: It was estimated at $21.48 billion, down 21.3% from the previous month and down 28.9% over the same period last year. The structure of the group of imported goods in January 2023, the group of production materials accounted for 93%.

- Import and Export Market: The United States is Vietnam's largest export market, with an estimated turnover of $7.6 billion. China is Vietnam's largest import market, with an estimated turnover of 8.1 billion USD.

- Balance of trade: The estimated trade surplus is 3.6 billion USD. The domestic economic sector has a trade deficit of 1.04 billion USD; the foreign-invested sector (including crude oil) has a trade surplus of $4.64 billion.

More CARBON TAX pressure for businesses

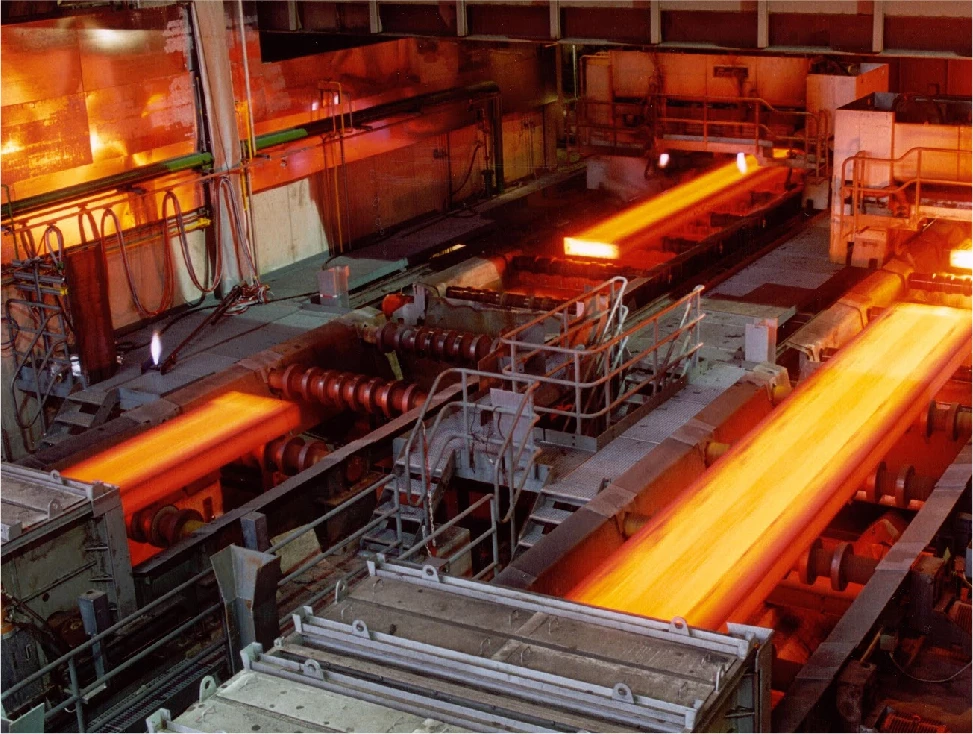

In mid-December, the EU announced that it would implement a Carbon Border Adjustment Mechanism (CBAM). The market will then levy a carbon tax on all exports imported into it based on the intensity of greenhouse gas emissions in the production process in the host country. Pascal Canfin, Chairman of the European Parliament's Environment Committee, said that for the first time, Europe had ensured fair treatment of businesses between those that pay the price of no bids of carbon in Europe and those that pay the price of carbon in other countries. This helps Europe do more for the current climate to protect businesses that comply with environmental protection criteria and workers' jobs. Therefore, CBAM will initially apply to high-risk imported goods such as steel, cement, fertilizer, aluminum, electricity, and hydrogen. These are sectors that account for 94% of Europe's industrial emissions. Importers will have to report the emissions contained in imported goods. If these emissions exceed European standards, businesses are required to buy emissions certificates at the current carbon price in Europe. This creates a big problem for companies exporting Vietnamese goods to Europe, which is adding an environmental certificate to be able to circulate in this fastidious market.

BIG PROBLEM for exporters

Faced with this policy, enterprises exporting Vietnam to the European market need to have particular solutions. CBAM is first applied to products with significant carbon emissions, such as iron and steel, cement, fertilizer, electricity, etc., so businesses in other fields still have time to prepare until the European Union implements can be responded to immediately. In addition to purchasing carbon certificates and meeting carbon tax criteria when exporting goods to the European market, businesses can also "go green" to ensure safety for the environment by many various production methods, fabrication, and processing applications.

Sharing about green production, reducing the pressure of carbon emissions to the environment, Ms. Nguyen Thi Lien, Deputy General Director of Phong Phu Joint Stock Company, said that the textile industry belongs to the products that must comply with current greening standards with 75 - 96 evaluation criteria. This not only helps businesses meet standards and improve their reputation with partners but also increases product competitiveness and has more orders, especially high-end brands. Many businesses have prepared for the issue of environmental protection in production, protecting the living environment of consumers many years ago, but still, need a specific certification. Therefore, the remaining thing is to settle carbon certificates so that goods "add lubricant" when entering the problematic European market.

1192 establishments must have greenhouse gas inventory (GHG)

In early 2022, the Prime Minister issued Decision No. 01/2022/QD-TTg on the fields and facilities that emit greenhouse gases that must carry out a GHG inventory. According to the roadmap for the implementation of the inventory report, 1,192 facilities in 6 areas: Energy, transportation, construction, industrial processes, agro-forestry, land use, and waste will have to provide actionable data and relevant information for the 2022 GHG inventory before March 31, 2023. This is considered the first step for businesses if they want to be recognized for their results in reducing greenhouse gas emissions and protecting the environment. It is also an essential opening for Vietnam's Net Zero implementation plan so that businesses can self-assess their current emissions level, have an appropriate adjustment strategy, and will be the basis for the State to issue emission limits for each enterprise.

Vietnam is expected to pilot a carbon credit exchange operation in 2025 and officially operate from 2028 to connect and exchange domestic carbon credits with the regional carbon market and the world. Dr. Nguyen Van Minh (Department of Climate Change) said that carbon credits and emission quotas are two items of the carbon market. Carbon credits are obtained from corporate emissions reduction activities and are certified by credit issuance mechanisms. The State allocates greenhouse gas emission quotas to enterprises. When enterprises emit more than the threshold, they can buy more quotas issued by the State or from other subjects who are also granted quotas but do not use them all. That is the buyer-seller of the carbon market. Therefore, to enjoy the market's benefits, businesses need to actively learn the legal regulations on GHG emission reduction and the carbon market. In particular, it is necessary to strengthen the capacity of GHG inventory and implementation of GHG emission reduction activities, mechanism of exchange, and offset of carbon credits.