Notes on Certificate of Origin (C/O) when conducting post-clearance inspection

To avoid unnecessary risks, businesses should pay attention to the following points:

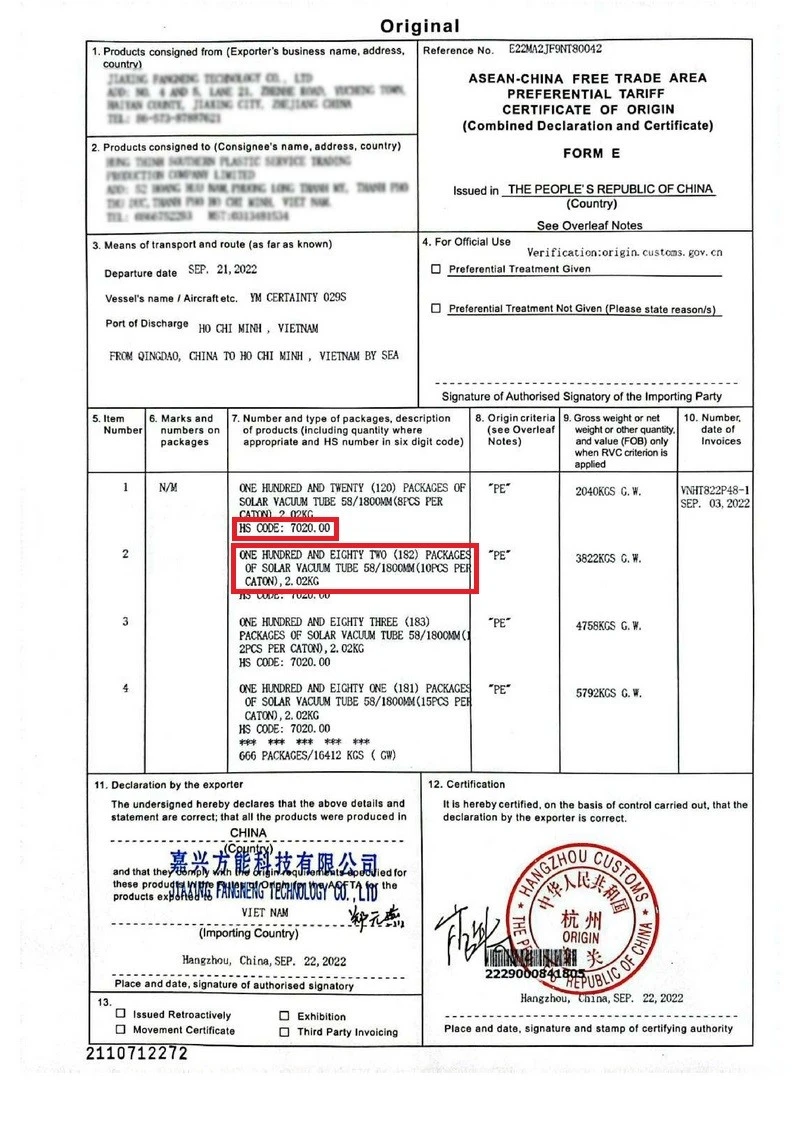

Firstly, businesses need to accurately determine the HS code of the exported goods. Incorrect HS code determination can lead to incorrect self-certification of origin and improper application of origin criteria as specified. The cause of this error is often due to declaring imported goods as separate parts instead of complete units, or intentionally declaring incorrectly to meet the criteria for obtaining a Certificate of Origin (C/O).

Secondly, businesses need to tightly control the backward calculation of raw materials used in production. The material list for calculating the origin criteria must be consistent with the actual production of exported products. Common errors in this process include: including inappropriate documents, declarations, or invoices in the material list; inability to control the actual inventory of raw materials; including unrealistic materials in the material list that constitute exported products; failure to track the segregation of the origin of materials...

Thirdly, the standard and basis for determining the actual level of C/O application must align with the actual production. Possible errors include: C/O application standards not matching the cost calculation standards; discrepancies between import-export-stock records and the backward calculation list when applying for C/O; departments applying for C/O self-balance the standards and adjust the compliance ratio without valid documentary evidence...

To prevent and limit risks, businesses need to implement the following measures:

- Consolidate, analyze, and control detailed documents, create a backward calculation table for each C/O application, and trace the materials used in production for each batch of exported goods.

- Accurately calculate the actual inventory based on declarations and invoices, incorporate them into the detailed list, and reconcile them with actual production, accounting records, and warehouse records. Clearly determine the remaining quantity of materials to be included in the next C/O application.

- Exclude the amount of materials that have been re-exported, destroyed, or consumed domestically from the list and backward calculation when applying for C/O.

- The C/O application standards and materials included in the list must closely follow the accounting cost calculation standards for the product. Maintain complete documentary evidence to prove and explain.

Additionally, businesses need to be prepared to provide explanations when customs authorities request documents such as cost calculations, technical standards, production processes; documents to verify the HS code of the goods; import-export-stock records from accounting and warehouse records for cross-referencing with the C/O application.

Compliance with C/O regulations not only helps businesses avoid hefty fines ranging from 20-70 million VND according to Decree 98/2020/NĐ-CP and Decree 17/2022/NĐ-CP, but also facilitates smooth import-export operations and prevents negative impacts on the company's reputation. Therefore, businesses need to pay close attention and strictly comply with the regulations to mitigate risks during post-clearance inspections.