Q3/2025 Ocean Freight Rate Volatility: Impacts from Vietnam–U.S. Trade Negotiations and Middle East Tensions

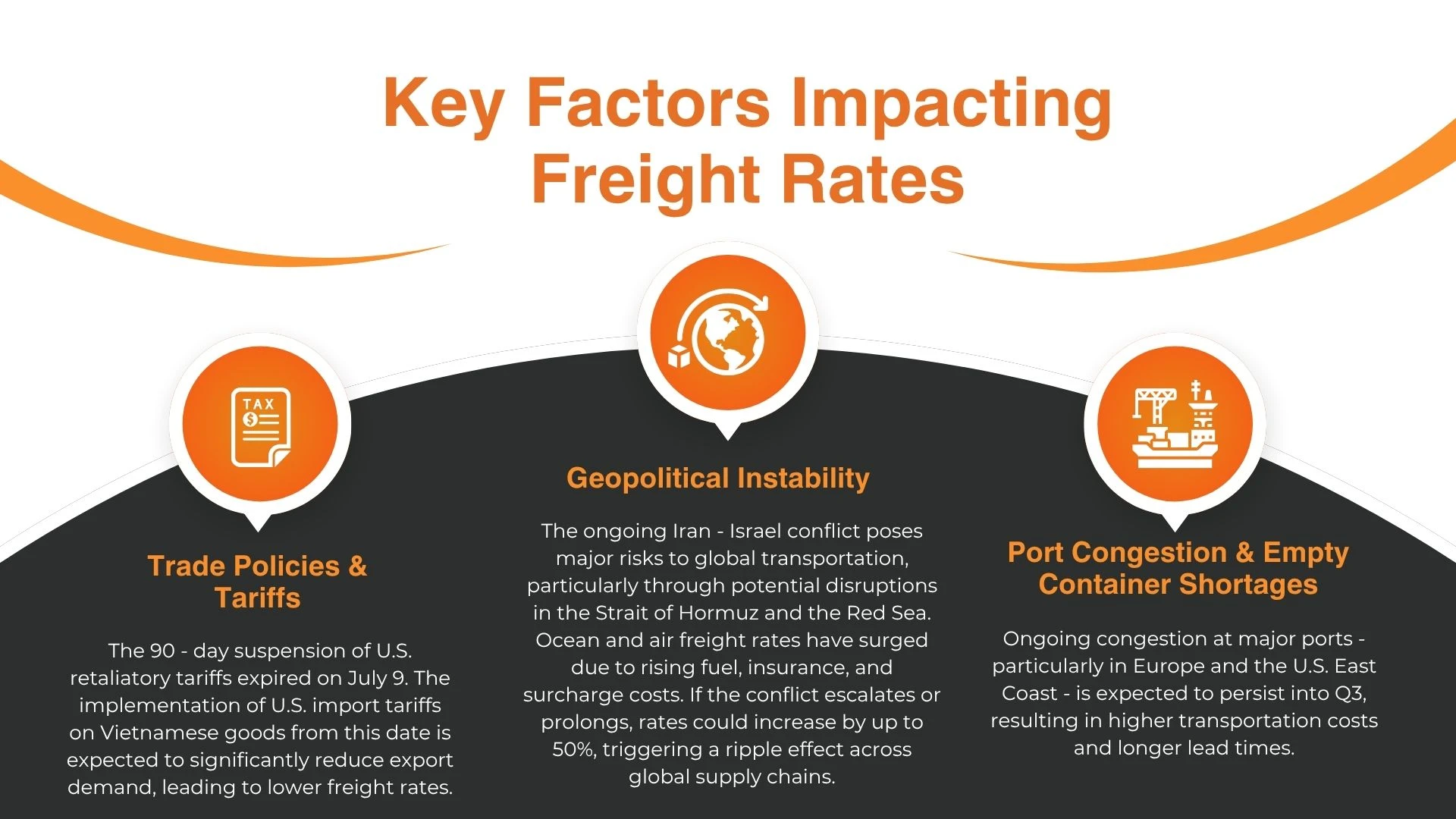

Since early 2025, the global ocean freight market has witnessed unexpected fluctuations. From escalating geopolitical tensions in the Middle East to the looming threat of high U.S. tariffs on Vietnamese goods, these factors are placing significant pressure on supply chains and logistics costs in Q3/2025.

According to the latest Procurement Department report (June 2025), freight rates are expected to vary by route, heavily influenced by the outcomes of Vietnam–U.S. trade talks and the evolving Middle East crisis. In this context, import-export businesses must proactively develop flexible contingency plans to optimize costs and ensure supply chain continuity.

Pressure from Vietnam–U.S. Trade Talks: A Critical Phase

Vietnam is among the first countries to enter counter-tariff negotiations with the U.S. following President Trump’s announcement of tariffs of up to 46% on key Vietnamese exports, including furniture, e-bikes, electronics, and solar panels. Since April, the two sides have undergone three rounds of talks, but progress remains slower than expected, with no formal agreement reached.

The U.S. has outlined several key demands: reducing reliance on Chinese technology, increasing imports of U.S. goods, enhancing supply chain transparency, and combating trade fraud. Vietnam has shown goodwill and initiative, but has not yet been able to fully meet these critical requirements within a short timeframe.

July 9, 2025, is considered a pivotal deadline. The negotiation outcomes will define the future of bilateral trade and determine whether the looming “tariff storm” will directly affect Vietnam’s logistics, exports, and foreign direct investment (FDI).

Middle East Tensions and the Surcharge Surge

Following U.S. airstrikes on Iran's nuclear facilities, the potential closure of the Strait of Hormuz—a vital artery for global oil transport—has led shipping lines to impose Peak Season Surcharges (PSS). As of mid-June, Maersk and CMA CGM have introduced surcharges of up to USD 4,000 – 4,100 per container on routes from Asia to North America and Europe.

Despite a temporary ceasefire, risks remain high. Continued disruptions in the Strait of Hormuz or the Red Sea could further inflate fuel and insurance costs, potentially driving freight rates up by 30–50% in the short term. Alternative ports such as Jebel Ali (UAE) are also facing congestion risks due to redirected cargo volumes.

Key Factors Driving Q3/2025 Freight Rates

Besides trade policy and geopolitical concerns, Q3 freight rates are shaped by two internal market factors:

- Export peak season (August–September): Demand will rise again as companies prepare for the holiday season in the U.S. and EU, following a slight dip in July.

- Fleet capacity growth: Since mid-2024, major carriers have deployed new vessels—especially on trans-Pacific routes. This oversupply is exerting downward pressure on rates, particularly on Vietnam–U.S. services.

Three Potential Scenarios for the Q3/2025 Freight Market

Based on data analysis and expert evaluation, the report outlines three possible freight rate scenarios for Q3, depending on the outcomes of Vietnam–U.S. negotiations and regional developments:

Scenario 1 – Tariff Avoidance (Likelihood: 20–30%)

If a framework agreement or a temporary delay in tariffs is achieved, rates are expected to remain stable, with a slight uptick in September due to seasonal demand. The Vietnam–U.S. route will recover after softening in July. European and intra-Asia routes may also see modest increases.

Impact: This is the most favorable scenario. FDI remains stable, and logistics and export operations continue without major disruptions. Cost pressures are minimal, allowing businesses to plan long-term with greater confidence.

Scenario 2 – Compromise Tariffs at 20–25% (Likelihood: 50–60%)

In this neutral scenario, although a comprehensive deal is not reached, the U.S. may lower its proposed tariffs to 20–25% in exchange for more concrete commitments from Vietnam.

Freight rates on the Vietnam–U.S. route may drop significantly—by 20–30%—in the first two months of the quarter due to reduced demand. However, rates on routes to the EU, Middle East, India, and intra-Asia may rise slightly (10–15%) as exporters shift to alternative markets and transshipment strategies.

Impact: Companies must restructure orders and distribution channels. Domestic logistics will face adjustment pressures. Some FDI may reassess investment strategies, though no significant capital flight is expected yet.

Scenario 3 – Full Implementation of 46% Tariffs (Likelihood: 10–20%)

This is the most adverse scenario. If negotiations completely fail, the U.S. will impose steep tariffs on nearly all key Vietnamese exports.

Vietnam–U.S. freight rates could plummet by 40–50% throughout Q3 due to a sharp drop in cargo volume. Conversely, rates to the EU, intra-Asia, and the Middle East may surge by 25–30% as exporters scramble to shift orders to alternative destinations.

Impact: There's a high risk of FDI withdrawal as investors pivot supply chains to countries like India, Thailand, or Mexico. Vietnamese exporters will need to redirect trade to Europe, Japan, or the Middle East. Logistics costs will rise, and the supply chain may face serious disruptions.

Proactive and Flexible Planning Is Essential

In today’s uncertain global landscape, the most crucial strategy for Vietnamese enterprises is to anticipate risks and diversify export markets. Over-reliance on the U.S. is no longer a viable long-term option. Businesses must also closely monitor geopolitical developments and work with logistics partners to adapt shipping plans accordingly.

Ocean freight rates are not merely a cost factor—they serve as a key indicator of supply chain health. Businesses that stay ahead of market shifts will gain a significant competitive edge in the second half of 2025.