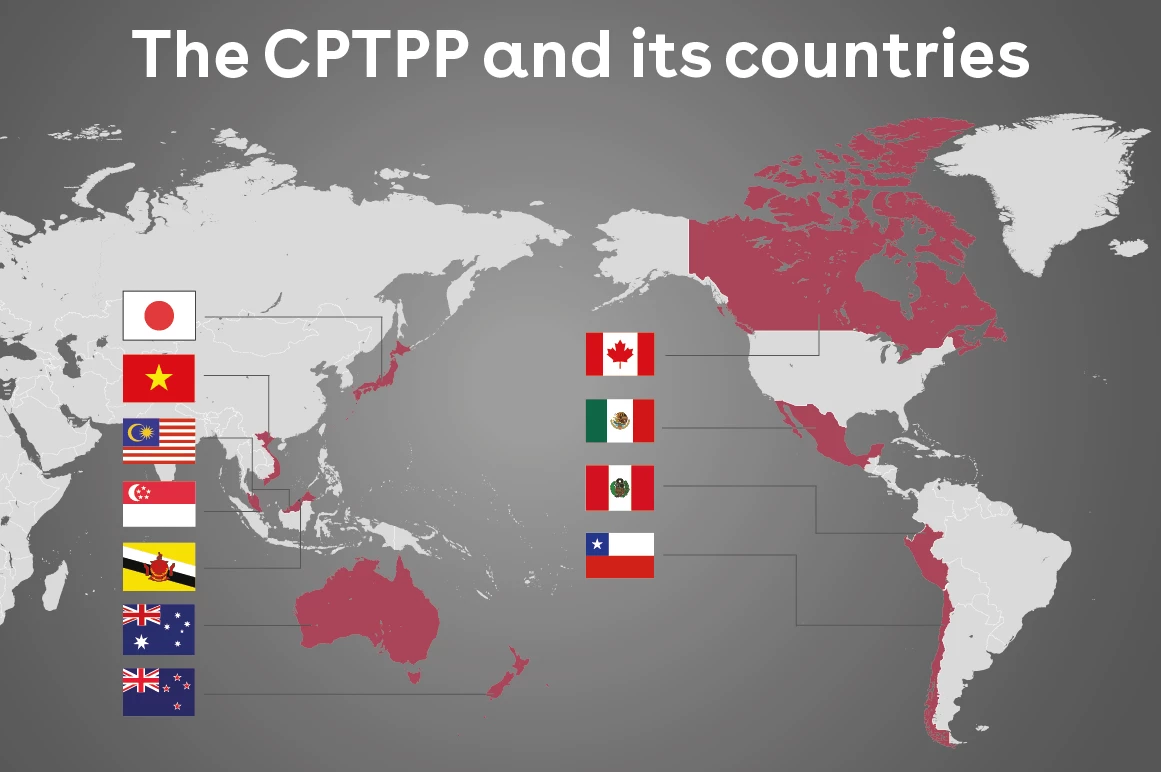

Vietnam still leaves many opportunities in CPTPP untapped November 10, 2023

It has been over 4 years since the CPTPP Agreement took effect, but many businesses are still facing difficulties in taking advantage of export opportunities. At a time when they were gradually accessing the agreement, the Covid-19 pandemic broke out, further burdening businesses with difficulties piled upon difficulties regarding transportation costs, rising production costs, and limited supply of raw materials, etc.

The Vietnamese cement industry is a typical example of struggling to implement the CPTPP. The biggest challenge here is the geographical location, as the long distance means relatively high transportation costs. A representative of the Vietnam Cement Association said: "After Covid-19, Vietnam gradually overcame difficulties but other countries were still heavily affected, leading to much investment difficulties. In addition, the cost of raw material inputs is quite large, plus the increase in transportation fees, domestic trading and exporting face many challenges."

In addition, Vietnam's export products still face many barriers to meeting the high quality standards of CPTPP markets. Strict markets like Canada demand high product standards, with production processes needing to ensure community responsibilities, environmental responsibilities, labor standard compliance, etc.

Moreover, the domestic content in Vietnam's exported products remains low (for example, Vietnam mainly exports agricultural and aquatic products in raw or frozen form), resulting in low added value, affecting the competitiveness of products in the market. Deputy Director Bui Hong Anh of the Europe - America Market Department (Ministry of Industry and Trade) recommends: "In the coming time, in addition to increasing export turnover, it is necessary to pay more attention to increasing domestication rates and added value in Vietnam's products, focusing on green, sustainable products. Always find out what the market needs with the spirit of not selling what we have but selling what the market needs."

Furthermore, some Vietnamese businesses feel they have "enough" and do not further exploit benefits from the CPTPP. Mr. Ngo Chung Khanh, Deputy Director of the Multilateral Trade Policy Department (Ministry of Industry and Trade), believes: "The reason for this situation is that businesses are afraid to build brands and accept 'keeping low profile', accepting pure outsourcing work, not wanting more. Or in another case, a representative of a cashew nut processing and exporting company said that they do not build brands because they are an outsourcing company. If they receive orders, they will fulfill them with the importer's labels. As the order quantities are very large, the company is also not enthusiastic about building their own brands.

Another disadvantage for Vietnamese businesses is the lack of financial, human and modern machinery and equipment resources. To meet high product quality standards, production processes and advanced technology application in production are needed, but this requires significant costs and skilled labor.

A reality is that FDI sectors in Vietnam contribute a large part of the total export value overseas. Specifically for the Canadian market, the FDI sector accounts for up to 80% of export values in textiles, footwear, wood furniture industries. Meanwhile, in these industries, Vietnamese businesses only account for about 5% of total export value. The domestic industrial sector contributes about 11% to the total export value of plastic, rubber, steel, aluminum, chemical, ceramic products. Currently, most of Vietnam's exporting businesses are small and medium sized, with less competitive advantages than FDI businesses.

According to Ms. Tran Thu Quynh - Trade Counselor of the Trade Office of Vietnam in Canada, although there is no specific statistics on the number of exporting businesses with their own brands, the number of businesses with export brands is also very modest, especially for CPTPP markets. Specifically in the Canadian market, Vietnam's exported goods to this market until now have enjoyed all preferential tariffs under MFN, GSP and CPTPP. Since the CPTPP agreement took effect, the export volumes of items with 0% tariff rates such as phones, seafood, vegetables, rice, cashews have increased sharply.

However, the rate of use of CPTPP tariff preferences for exports to Canada remains low, only reaching about 18%; 81% of Vietnam's exports to Canada still use MFN tariff preferences and about less than 1% still use GPT tariff preferences (tariff preferences applied by Canada for developing and least developed countries), GSP. The rate of use of CPTPP tariff preferences for exports to Canada has increased steadily over the past 5 years but about 60% of products (around 4 billion USD) have still not been able to take advantage of 0% tariffs.

Therefore, Vietnamese businesses must have specific tactical strategies to fully leverage and exploit opportunities from the Comprehensive and Progressive Trans-Pacific Partnership Agreement (CPTPP) to gain competitive advantages for their businesses.