[Expert Talk] What is a Customs Settlement Report? How does it differ from a company's Financial Report?

- What is a Customs Settlement Report? How to understand it correctly?

- How does a Customs Settlement Report differ from a company's Financial Report?

- Why do businesses often encounter discrepancies in data on Customs Settlement Reports?

- Some measures to address discrepancies in data on Customs Settlement Reports

What is a Customs Settlement Report? How to understand it correctly?

A Customs Settlement Report is the final stage where a business demonstrates, explains, and reports to prove whether they have complied with the legal regulations on tax-free import of raw materials and supplies.

Businesses engaged in export processing, processing and production enterprises customs procedures are responsible for reporting the use of imported raw materials, supplies, and exported goods to the customs authorities based on the financial year. Therefore, businesses must manage and monitor imported raw materials, supplies, and exported products from the time of import, through the production process, until the product is exported or the purpose of use changes, and handle waste, scrap, surplus materials, machinery, and equipment used for production according to legal regulations on their accounting books and records as per the regulations of the Ministry of Finance and based on inventory sources (imported or domestically purchased). Imported materials and supplies are tracked in detail according to each type of import during the period (processing import, production export import, business import, re-import of raw materials after production, etc.) declared on the customs declaration and the import documents for the period.

How does a Customs Settlement Report differ from a company's Financial Report?

A Financial Report is a report on the business activities of a company, based on which the company calculates the amount of VAT and corporate income tax, along with other fees and taxes as per legal regulations. Most businesses are required to prepare financial reports.

A Customs Settlement Report is only required for businesses involved in tax-free imports, not subject to import tax on raw materials (Export processing, processing and production enterprises types). The Customs Settlement Report only pertains to a part of the financial report (books, documents, accounting records, and inventory related to tax-free imported raw materials). It requires businesses to demonstrate the use of tax-free raw materials for the correct purpose according to legal regulations. Misunderstanding the regulations or mismanaging can lead to tax risks, administrative penalties, and late tax payment fines for businesses.

Why do businesses often encounter discrepancies in data on Customs Settlement Reports?

In reality, many businesses still face discrepancies in the data on the import-export-inventory of raw materials, supplies, and finished goods among the accounting, warehouse, and import-export departments, which they cannot explain during official inspections. What causes these serious errors?

- Businesses have not assigned appropriate personnel for the customs settlement reporting work, and the accounting, warehouse, and import-export departments have not coordinated or shared information related to settlement report data.

- Businesses do not regularly update customs laws and new regulations related to import-export.

- Relevant departments have not been given detailed guidance on how to implement the customs settlement report forms.

- The norms set are not realistic, lacking a basis for explanation (documents, records establishing usage norms and actual norms).

- Handling of waste and scrap is not compliant with legal regulations.

- Raw materials and supplies imported from multiple sources are not managed in detail, causing confusion in the inventory of processing contracts.

- Selling raw materials without production but not declaring them.

- Failing to manage declared data, revised, and canceled declarations tightly, leading to decentralized data storage.

Some measures to address discrepancies in data on Customs Settlement Reports

Given this urgent situation, InterLOG has proposed several solutions to help businesses minimize errors, especially avoiding discrepancies in Customs Settlement Report data:

- Disseminate relevant legal regulations on the management and use of tax-free imported raw materials to related departments such as accounting, warehouse, and import-export so they understand and manage, record, and share information correctly and fully.

- Assign a department to compile, reconcile data, and share with other departments to understand the meaning of each indicator related to the customs settlement report forms to declare and submit to customs authorities.

- Set realistic norms with the involvement of technical, production, warehouse, and accounting departments, supported by records and documents, and manage waste and scrap properly and in detail to explain and justify actual norms to customs authorities.

- Conduct periodic inventory checks, find the causes of discrepancies among departments, and propose early solutions.

- Control the declaration, adjustment, and cancellation of customs declarations, with all data stored centrally and backed up periodically.

Summary of essential information about Customs Settlement Reports

Customs Settlement Report forms that businesses need to know:

- Forms No. 25, 26, 27 under Appendix II of Circular 39/2018/TT-BTC (electronic forms)

- Forms No. 15/BCQT-NVL/GSQL, 15a/BCQTSP-GSQL, 16/ĐMTT-GSQL issued under Appendix V of Circular 39/2018/TT-BTC (paper forms)

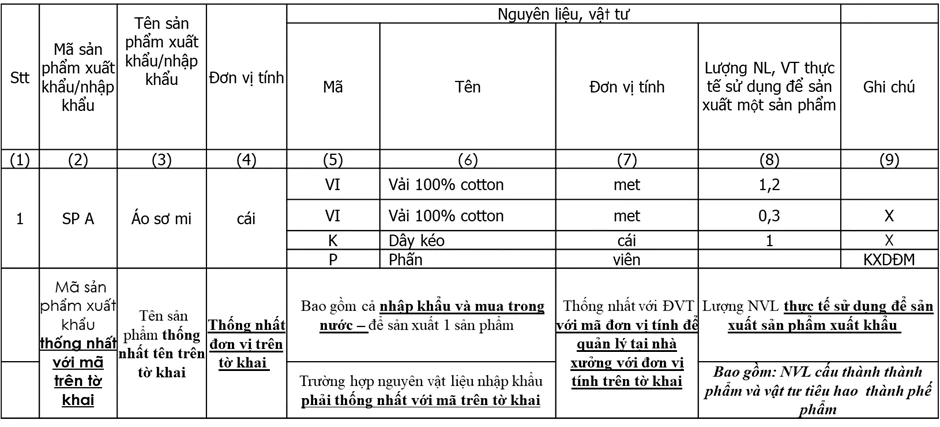

Form 15/BCQT-NVL/QSQL (Form 25)

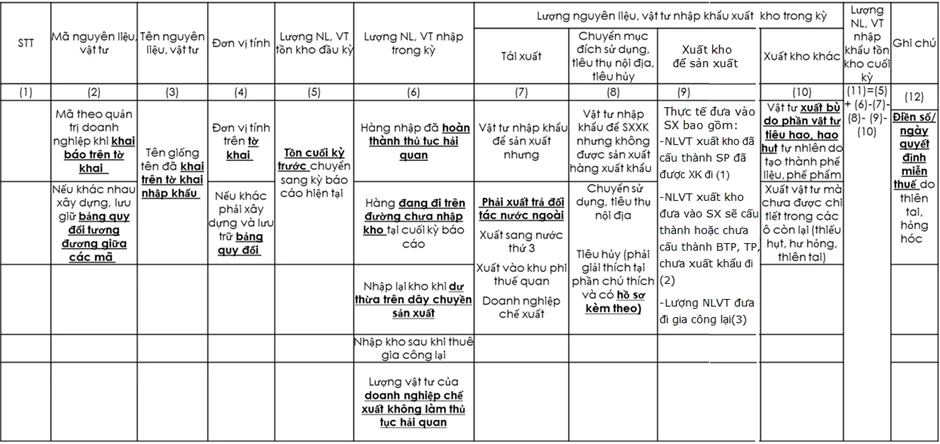

Settlement report with imported materials

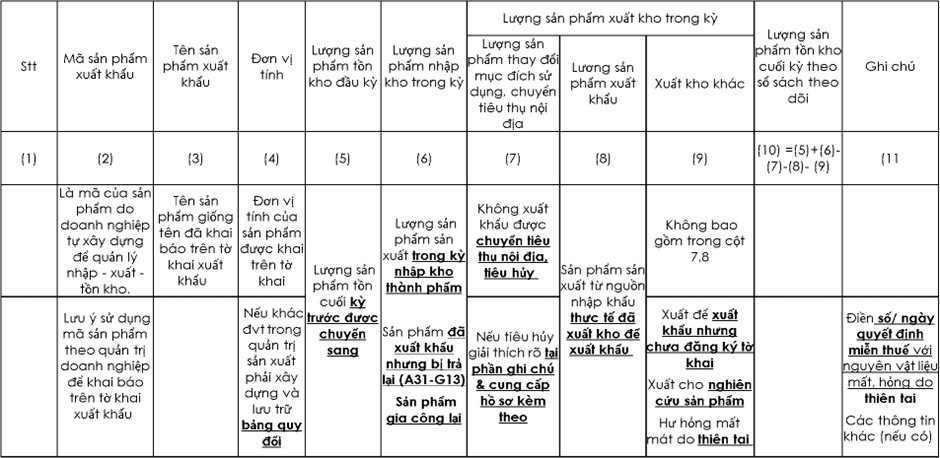

Form 15a/BCQT-NVL/QSQL (Form 26)

Settlement report with export products

Form 16/BCQT-NVL/QSQL

Actual use norms